The Only Guide to Final Expense In Toccoa, Ga

Table of ContentsAll about Annuities In Toccoa, GaWhat Does Home Owners Insurance In Toccoa, Ga Do?Our Health Insurance In Toccoa, Ga IdeasMedicare/ Medicaid In Toccoa, Ga - TruthsMore About Insurance In Toccoa, GaNot known Facts About Home Owners Insurance In Toccoa, Ga

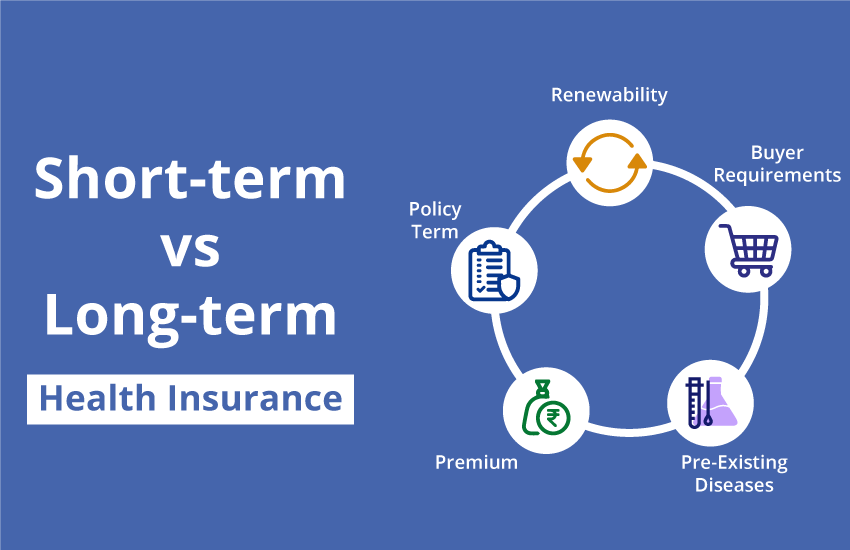

See if you are qualified to utilize the Health Insurance policy Industry. To be eligible to enroll in wellness protection via the Market, you: Under the Affordable Care Act(ACA), you have unique client security when you are guaranteed through the Health Insurance Policy Marketplace: Insurance firms can not decline coverage based on gender or a pre-existing problem. Some legal rights and defenses apply to plans in the Health and wellness Insurance Market or other private insurance coverage, some apply to job-based strategies, and some use to all wellness protection.With clinical expenses skyrocketing, the demand for private health insurance policy in this day and age is a financial fact for lots of. Within the category of personal

health health and wellnessInsurance coverage there are significant substantial between a health health and wellness handled (HMO)and a preferred favored service provider(PPO)plan. Of program, the most obvious advantage is that private health and wellness insurance coverage can provide protection for some of your health care costs.

The Definitive Guide to Medicare/ Medicaid In Toccoa, Ga

Numerous specific plans can set you back several hundred bucks a month, and family members coverage can be even higher. And even the a lot more comprehensive policies included deductibles and copays that insureds should fulfill prior to their coverage begins.

Most wellness strategies must cover a set of preventative solutions like shots and screening examinations at no cost to you. https://www.pearltrees.com/jstinsurance1#item573568184. This includes plans available with the Health Insurance Policy Marketplace.

10 Simple Techniques For Insurance In Toccoa, Ga

When you acquire insurance coverage, the monthly expense from your insurer is called a costs. Insurer can no more bill you a greater premium based on your health and wellness status or as a result of pre-existing medical conditions. Insurer supplying major medical/comprehensive plans, established a base rate for everybody that purchases a medical insurance plan and after that adjust that rate based on the aspects listed below.

Normally, there is a tradeoff in the costs quantity and the costs you pay when you get treatment. The greater the monthly premium, the Continued lower the out-of-pocket expenses when you get treatment.

For more details on kinds of health insurance coverage, call your company advantage rep or your financial professional. In summary, here are a few of the pros and cons of using exclusive medical insurance. Pros Multiple options so you can select the most effective plan to satisfy your private requirements Typically provides higher versatility and access to care than public health insurance Can cover the cost of pricey treatment that may occur suddenly Fools Pricey with premiums climbing every year Does not guarantee complete access to care If you want to discover more regarding saving for healthcare or just how healthcare can influence your family members budget plan, check out the Protective Understanding.

Fascination About Annuities In Toccoa, Ga

The majority of health and wellness plans should cover a set of preventative services like shots and testing tests at no cost to you. This consists of plans readily available via the Health Insurance Policy Industry.

When you purchase insurance, the month-to-month bill from your insurer is called a premium. Insurer can no much longer charge you a greater premium based upon your health and wellness standing or because of pre-existing clinical conditions. Insurance policy business supplying major medical/comprehensive plans, set a base rate for every person that purchases a health insurance coverage strategy and after that change that price based on the variables listed here.

Usually, there is a tradeoff in the premium quantity and the prices you pay when you obtain care. The greater the monthly costs, the lower the out-of-pocket expenses when you obtain care.

Fascination About Medicare/ Medicaid In Toccoa, Ga

Most health and wellness plans need to cover a collection of preventative solutions like shots and testing tests at no expense to you. This includes strategies offered via the Wellness Insurance Policy Marketplace.

When you buy insurance, the monthly costs from your insurance provider is called a premium. Insurer can no much longer bill you a higher costs based upon your health and wellness condition or due to pre-existing clinical conditions. Insurance provider providing major medical/comprehensive plans, established a base rate for every person who buys a medical insurance plan and after that change that rate based upon the elements listed below.

The Main Principles Of Insurance In Toccoa, Ga

Usually, there is a tradeoff in the costs quantity and the expenses you pay when you get care - Insurance in Toccoa, GA. The higher the monthly costs, the lower the out-of-pocket costs when you obtain treatment

Comments on “An Unbiased View of Home Owners Insurance In Toccoa, Ga”